Fast & accessible support close to payoff

Kiavi’s in-house Servicing Team provides accessible service, swift issue resolution, and customized solutions to facilitate seamless and successful exits for our bridge loans.

Quick & accurate

We know our loans inside out, ensuring borrowers get accurate assistance with 9-second avg wait time to our main servicing line.

Dedicated contact

Loan nearing maturity? Get personalized assistance from a member of our team whose goal it is to support your successful exit strategy.

Unified team

Our Servicing team collaborates directly with your Account Manager to deliver optimal solutions tailored to your needs.

What to expect from our Servicing Team

While many lenders outsource or use external servicing for their Bridge loans, Kiavi’s own in-house loan Servicing Team works to ensure that Kiavi customers receive a consistent, fast and easy experience even after their bridge loan closes.

1. Welcome email

Upon closing your loan, you’ll receive a “Welcome" email from our US-based team providing essential loan details, including:

- Your first payment date

- Bank account information for draws and ACH transactions

- Your loan’s maturity date

- Contact information for starting the draw process

- Basic details regarding loan maturity

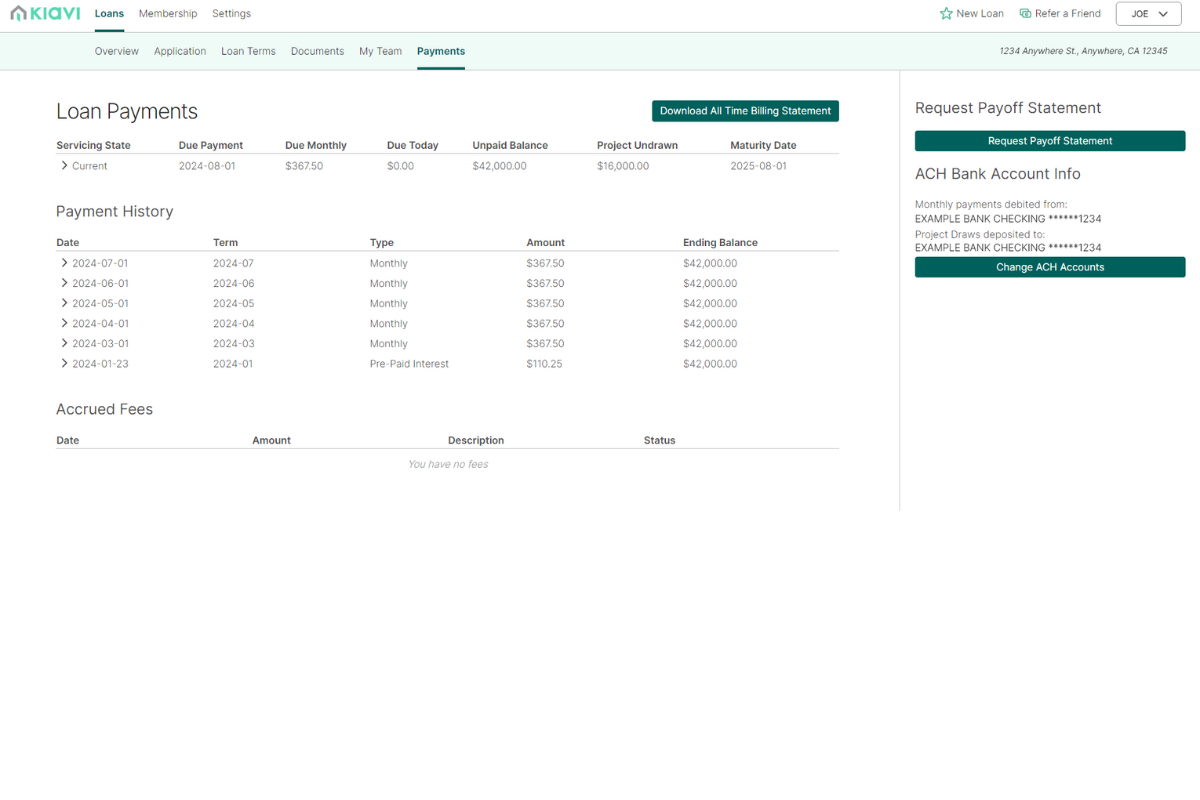

2. Visibility and support

You’ll have access to your loan details, including due and maturity dates, all within your borrower portal. Our team is ready to assist with any inquiries, managing payments, getting payoff information, or any other loan-related questions.

.jpg)

3. Proactive loan management

Most Kiavi borrowers pay off their loans well before maturity and move on to their next project. You can request your payoff statement directly from your borrower portal. If your loan is approaching maturity, a Default Prevention Specialist will be assigned to assist you with loan exit strategies or requesting an extension.

Kiavi's Wiring Instructions

Account Number: 4152786703

ABA Number: 121000248

Wells Fargo Bank N.A.

420 Montgomery Street

San Francisco, CA 94104

Kiavi Servicing FAQs

If you have questions, we have the answers! Here’s a list of the most common questions Kiavi customers ask. If you don’t see the answer to your question, just give us a call at (415) 964-4975.

Kiavi has always serviced all of our Bridge (or Fix-and-Flip) loans in-house. Your Bridge loans start and end with us.

Currently, our Portfolio and Rental loans are sent to a third party for servicing. If you have a Rental or Portfolio loan question, please contact your loan’s servicer for assistance.

If you are a brokered borrower or a third party, please email our team at payoff@kiavi.com with borrower authorization (if required). If all information is received, turnaround time is typically within 24 hours.

Account Name: Kiavi Funding Inc - Serv Hold

Account Number: 4152786703

ABA Number: 121000248

Wells Fargo Bank N.A.

420 Montgomery Street

San Francisco, CA 94104

Be sure to include PAYOFF FOR [LOAN NUMBER] [PROPERTY ADDRESS] in the wire reference so your funds are accurately applied.

Your title company or closing agent may also call our Servicing team at 415-964-4975 to confirm wiring instructions prior to sending.

Monday through Friday from 8:00am - 5:00pm EST

In Arrears…payments on all bridge loans are collected in arrears, meaning the August payment would satisfy daily interest accrued throughout the month of July.

Our Draws team can be reached by email at draws@kiavi.com, or you can call 415-202-6400 option 3.

Any phone messages left for the Draws team will be responded to within 24 hours during the week.

Yes.

If you have an IAD (Interest as Drawn) loan, Kiavi only begins charging interest for rehab funds when your draw amount(s) are taken. Any Construction Draw taken on your bridge loan will increase the Unpaid Principal Balance, increasing your monthly mortgage payment the following month.

Our bridge loans are not escrowed for the payment of tax or insurance premiums. You would be responsible for payment of any of these coming due during the term of your loan.

If you need to update Kiavi with new insurance information, you can simply email insurance@kiavi.com. or send documents directly to Processing at insdocs8201@oscis.com.

Unfortunately, our loan documents require your monthly payment to be drafted on the 1st of every month via ACH set up at the loan closing.

Your borrower portal will also show the current bank account being used for your monthly loan payments and provide further details on the documents required to update the bank account if necessary.

When a payment is missed, a Default Prevention Specialist will proactively contact you. Simply respond to that outreach or you may email us at servicing@kiavi.com to set up another payment attempt.

Note: Kiavi has a 15 day grace period on missed payments. If the payment is not satisfied by the end of that period, a 5% late fee will be assessed. Furthermore, the loan will roll 30 days delinquent if the payment is still outstanding by the last business day of the month. Please note the grace period will end the business day prior if the 15th falls on the weekend and Kiavi can only accept payment via wire transfer the last week of the month.

Note: All extensions are subject to approval and are typically offered for 3 months. A fee of 1% of the Unpaid Balance of the loan must be paid via wire transfer within five business days of approval.

All extensions are evaluated case-by-case, contingent upon factors such as project status, payment history, and how you intend to exit the loan. Your assigned Default Prevention Specialist will detail specific items/information needed for consideration.

If you expect the remaining renovations to exceed one 90-day term, we often recommend refinancing into a fresh bridge loan to provide sufficient time to rehab and exit.

>Note: To be eligible for a second extension, your properties must be confirmed 100% complete AND your exit strategy underway.

If your loan is not paid in full or extended by the last day of our grace period, default interest will begin to accrue per diem and is also applied retroactively to the 2nd of the month. Daily default interest accrues in addition to the regular interest amount, not instead of. If an extension is approved past our grace period, all accrued default interest must be paid with the extension fee. Please note if the 10th falls on the weekend of your loan’s maturity month, the grace period will end the business day prior.

Kiavi loans must be paid in full or extended by the last business day of the maturity month to avoid delinquency. After our 10-day grace period, all accrued default interest must be paid with the final wire. If you are concerned about closing delays, we recommend requesting our 3-month extension option—ideally before the end of our grace period to avoid default interest—to provide sufficient time to close and avoid the risk of delinquency.

Receiving an email from VerifyMyIns means that Kiavi needs updated insurance information for your loan. The email will contain a customized link to a secure portal, which you can access to upload your current or new insurance policy information.

VerifyMyIns streamlines the insurance verification process, allowing you to easily upload and manage your coverage documents in a smooth, customer-friendly way.

If you receive an Insurance Notice from Kiavi, follow the link in the email to VerifyMyIns and upload your updated insurance policy to the VerifyMyIns portal.

Using the Reference Number and your entity’s zip code from the Insurance Notice email you received from Kiavi, you can log in to the VerifyMyIns portal and instantly upload your insurance policy.

Kiavi Bridge loans are not escrowed for insurance premiums; therefore, you will need to ensure your policy remains active throughout the duration of your Bridge loan. If your policy expires before your Bridge loan is complete, you will receive an email with a secure link to VerifyMyIns to upload your new insurance documents so your loan remains compliant.

If your insurance policy is canceled for non-payment, you will need to provide Kiavi with an updated policy. You will receive an Insurance Notice email with a customized link to VerifyMyIns. Using this secure link, you can instantly upload your new policy details.

Yes, you can email the Kiavi insurance team at insurance@kiavi.com with any questions related to your insurance coverage.