For Brokers

Make competitive offers and scale your business

Use fast technology, competitive broker loans, and industry expertise to help your clients unlock the value of aged homes and scale your business.

Fast, easy financing for brokers

We're here to help your business grow with fast technology, reliable capital, and an industry-leading team to provide your customers with more competitive offers and confidence in closing.

Timely and reliable capital

Earn YSP up to 2.00% on fix-and-flip/ bridge and 1.00% on DSCR rental loan options. Access low fees and 0.00% origination on rental loans.

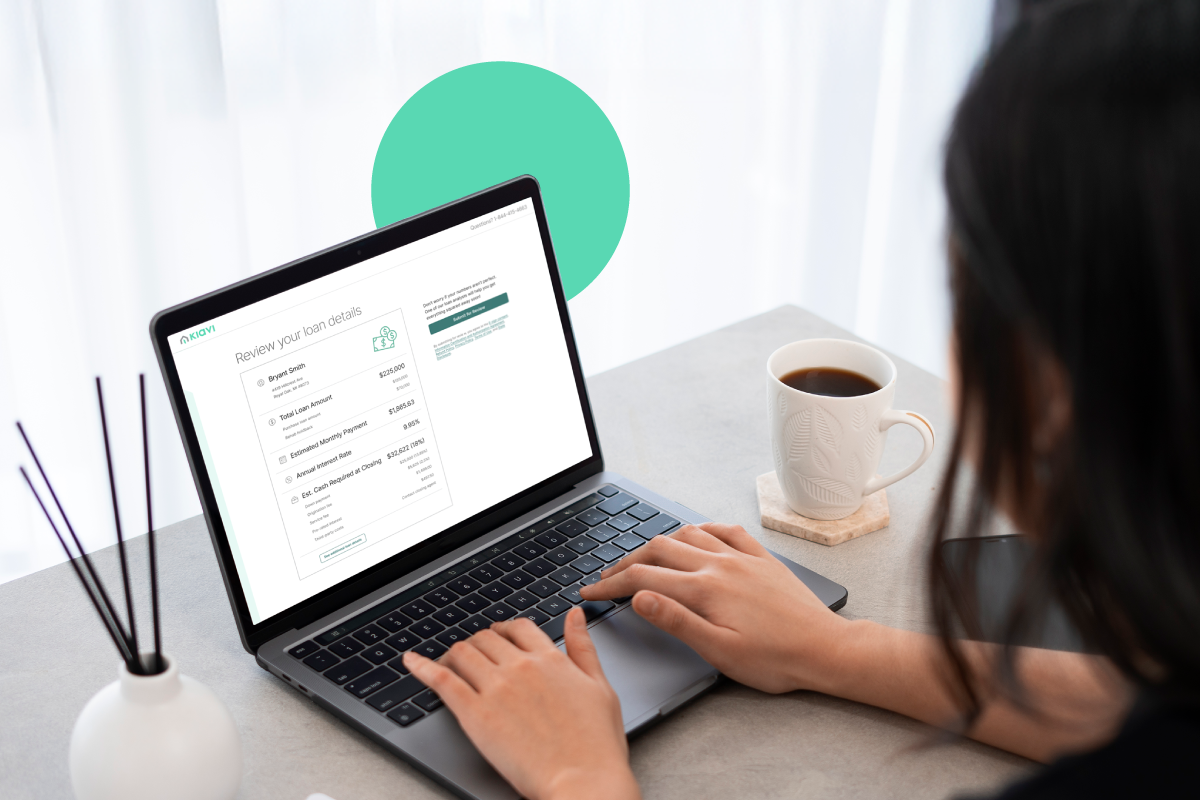

Manage all loans in one place

With a personalized online portal, you can view potential earnings, price out deals in minutes, and generate loan summaries and pre-qual letters 24/7.

Scale your business faster

Submit and originate loans in 30 minutes or less with comprehensive broker support and loan analysts. Deliver fast turn times and fast approvals in as few as 7 days!

The more you do, the more you get

Similar to your airline status, higher volume and performance unlocks additional perks with the Kiavi Platinum Broker Program. Brokers that qualify for the Kiavi Platinum Broker Program receive 50 bps or $999 origination fee (whichever is greater) and a broader credit policy.

Qualifications for this exclusive program include:

- Volume: Closed at least $6M+ in bridge volume with Kiavi in the past 6 months + consistent origination history in the past 18 months

- Performance: 2% or less DQ rate on seasoned Kiavi loans

Fix-and-Flip / Bridge Loan Rates + Terms

Our short-term financing options for purchasing or refinancing investment properties feature competitive rates with a variety of terms and options.

- No Application Fee

- No Appraisal

- No Income Verification

DSCR Rental Loan Rates + Terms

Our long-term financing for rental properties is designed to help real estate investors reap the benefits of property appreciation and rental income.

7/1 ARM

- Ask About Our Cash-Out Refinance Options

Navigate Your Path to Success with Kiavi's Broker Support Resources

Explore Kiavi's Broker Resource Center for invaluable tools and resources tailored to elevate your real estate investment strategies. Gain access to comprehensive guides, video tutorials, and expert broker support designed to streamline your processes and help you thrive in the competitive market.

- How to price out deals

- Loan dashboard overviews

- Submitting out a broker application

- Setting up profiles

- And so much more!

See why 17,000+ real estate investors trust Kiavi

From first-time flippers to seasoned pros, Kiavi provides the support, expertise, and capital to make real estate investing easier.

"Kiavi is amazing and Kate is a boss! And the processing team including Stephanie we're able to be clear with conitions and helpful on all getting resolved. They helped me secure a quick 10 day close on a recent transaction for an experienced client of mine. The process was smooth and painless compared to most. Would highly recommend. Thank you!"

Sean M.

06/20/25 via Google"I just completed a refinance loan on a rental property. I’m a real estate broker with over 20 years in the business and have been involved in many types of loans from various types of lenders. I really must say that I was extremely impressed with Kiavi staff [...]"

Eric R.

12/29/23 via Google"Kiavi have been an awesome partner in helping me achieve my Real Estate investment dreams. I have worked with other companies but they completely standout in professionalism, timeliness and flexible rates options."

Oracle F.

12/01/24 via Trustpilot"Fast and easy process. Everything was done in a timely manner. They were easy to reach when I had questions, and there were no surprises. Highly recommend!"

Kaveh N.

03/25/24 via TrustpilotGetting started with Kiavi

Looking for more information? Working with Kiavi on your client's deals is easy, fast, and transparent. Check out our resources to learn more about our processes and tech-powered platform.