Working with Kiavi

The rental loan process - from start to close

With a Kiavi Rental Loan, you can avoid the hassle of hopping from bank to bank with low total exposure limits and large required down payments. Our dedicated team is here to help guide you every step of the way.

Pre-qualification

To get prequalified, simply access Kiavi’s online platform, enter the property address and answer a few questions about yourself. The system will do a soft credit pull as part of the prequalification – unlike hard inquiries, soft inquiries will not affect your credit scores.

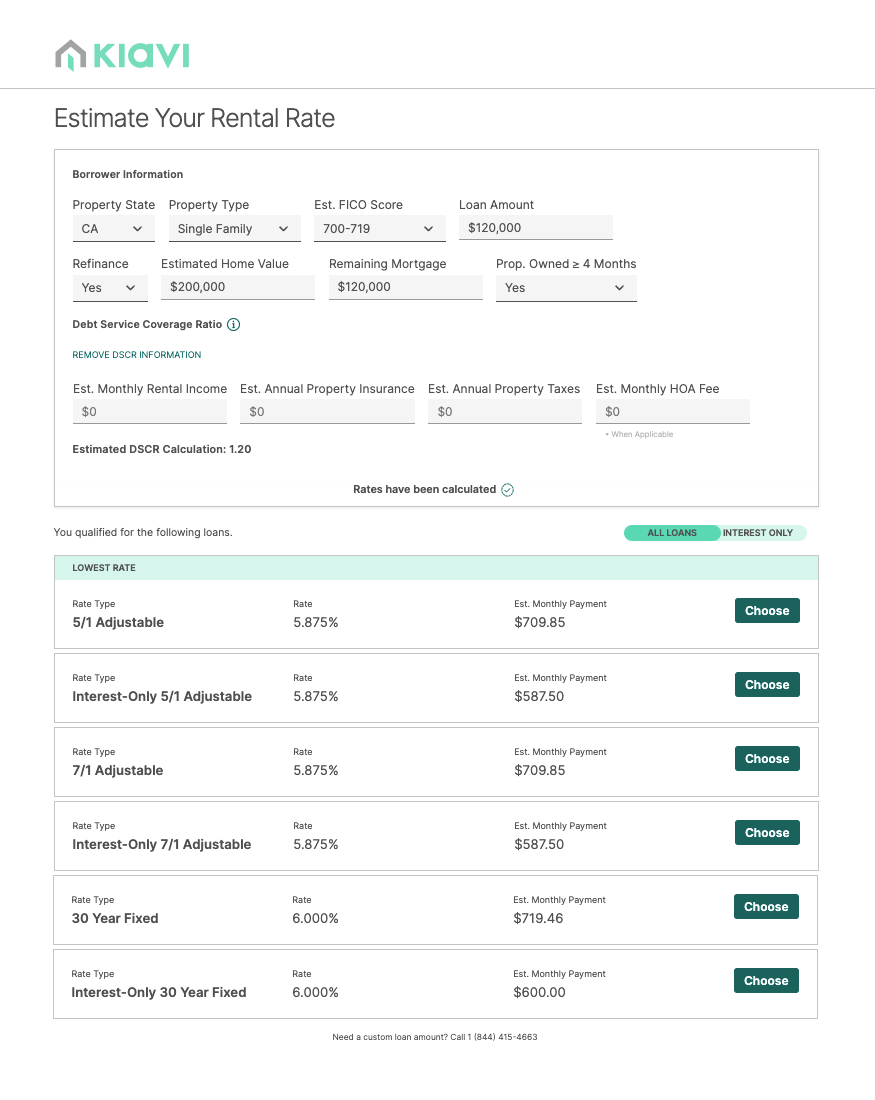

When qualifying real estate investors for long-term financing on rental properties, Kiavi will look at FICO and leverage as qualifiers to originate the loan. Leverage is dictated by FICO and DSCR (Debt Service Coverage Ratio) combined.

DSCR is used to measure and determine the maximum loan amount when a real estate investor applies for a new loan or refinances an existing one. Because DSCR measures the asset's ability to pay the property's mortgage and expenses, the higher it is, the more leverage the investor can get. The DSCR must be at a minimum of 1.1 to prequalify.

ProTip

ProTip

If you’re deciding between a couple of properties, call your Kiavi representative. We’ll review the numbers with you and lend you our experience and expertise – we’re here to help and answer all your questions.

Loan Application

When you’ve found your property and you’re ready to move forward, submit your application. Simply click the Submit for Review button on our online platform when you’re ready to submit your application for financing. For Kiavi’s Rental Loans, you will also be required to pay a third-party appraisal fee at the time of application.

Once the application is 100% complete and the third-party appraisal fee is paid, your loan will move to the next step.

Note

Note

After you've found a property, call your Kiavi representative before you submit your application. We'll run through the numbers with you and provide our insights and guidance from over 46K projects – we're here to help answer any and all of your questions.

Processing

Once the loan application is completed, it is assigned to a loan processor. Your processor will do an initial review and kick-off orders to the title and the insurance companies and request an appraisal. The appraisal is an unbiased professional opinion of a home's value and is required for all Kiavi rental property loans.

Appraisal

Once the appraisal is ordered, there is a waiting period in which the appraisal is accepted by the appraiser, scheduled and takes place. This process can take approximately 30+ days to complete. Once complete, the appraisal report is sent to Kiavi. This report is what ultimately determines the property’s value based on the certified appraiser’s observations.

Valuation

Kiavi’s valuations team reviews the appraisal report to ensure that the property falls in line with Kiavi’s credit policy and determines the loan to value (LTV) ratio. A loan to value ratio refers to the amount of the given loan in comparison with the value of the property. The remaining amount is paid by the borrower at closing.

Once any outstanding conditions have been satisfied, the analyst will send the appraisal to the underwriter for final review.

Underwriting

Kiavi’s team of underwriters will review the full file to make sure the loan meets all guidelines and standards as well as ensure the paperwork is accurate and error-free. The underwriter also has the ability to condition items back to the appraiser.

Note

Note

Respond quickly if your underwriter reaches out with any questions so that we can keep your loan on track and avoid delays to your closing.

Closing

Once approved by underwriting, it’s time to close on your loan. Our closing department will work with the title agent you selected at the beginning of the process to coordinate the closing date and provide the necessary documents.

Kiavi is responsible for sending all loan documents to the title agent to arrange for the borrower to sign and for wiring the loan proceeds to the title agent for delivery to the borrower. At closing, you will sign the required documents, exchange money and get the keys to the property.

The title company will ensure that you properly execute all the necessary loan documents required by law and that insurance is in place. Once the loan documents have been signed, the agent sends the original documents to the Kiavi and the funds are released.

Congrats!

Congrats!

You're now the proud property owner.

Also interested in financing your fix-and-flip?

Check out our Kiavi Bridge Loan Process guide for a walkthrough of that as well.