Building your real estate portfolio with BRRRR loans and Kiavi

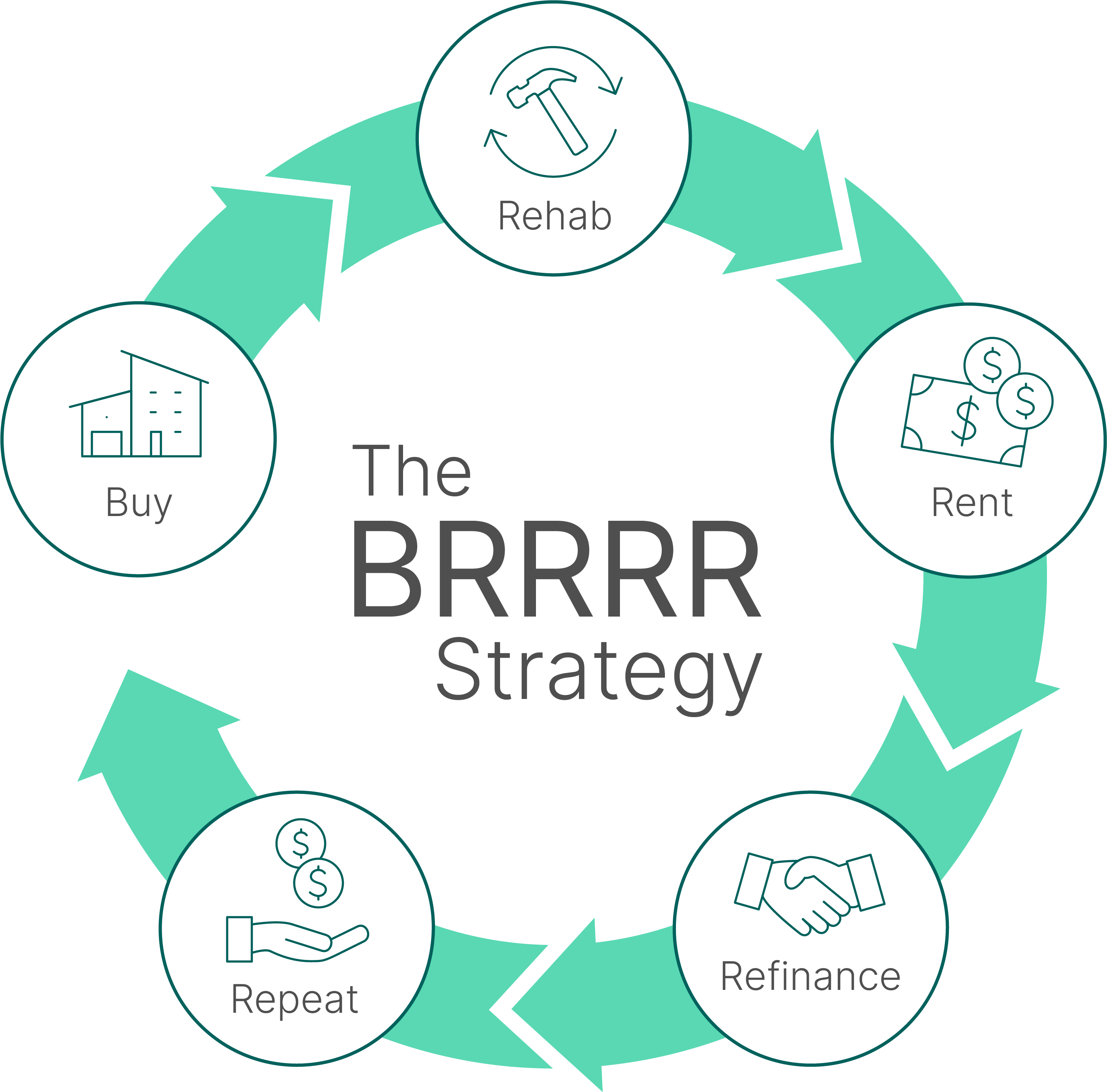

The BRRRR strategy is designed to help real estate investors create passive income without a huge initial outflow of capital. Kiavi can support your needs in each step of the process with fast and easy approvals, flexible loan options and expert guidance from an industry-leading team.

Financing the BRRRR loans strategy

Two separate loan transactions are typically required to fund investment properties when employing the BRRRR strategy.

When you acquire the property, you will take out a short-term fix-and-flip / bridge loan to cover the cost of both the purchase and the rehab of the property. These loans vary in length between 12 to 24 months, long enough to finish the rehab and rent out your property.

Then, you're ready to refinance to a long-term rental loan at a lower interest rate with the ability to take a cash-out option to purchase your next property. This makes repeating the process, again and again, possibly helping to fulfill your dreams of making money in real estate.

High leverage opportunities

We offer up to 90% LTC

Competitive loan rates

Maximize your returns with competitive rates on short-term bridge and long-term rental loans

Speed and simplicity

Our tech powered platform delivers on the needs of today's real estate investor

Capital at the ready

Kiavi offers flexible short-term and long-term investment property loans that are ideally suited for investors employing the BRRRR strategy. Take advantage of today’s low rates and experience easier access to funding.

Fix and Flip / Bridge loans

Gain leverage for the Buy and Rehab phases of BRRRR. Our short-term financing options for the purchase and rehab of investment properties feature competitive rates with a variety of terms and options.

Fix-and-Flip Rates + Terms

Rental loans

Once you rent your property, refinance it with our long-term rental loan options. Our rental loans are designed to help real estate investors reap the benefits of property appreciation and rental income. Available for single-family, PUDs, and 2-4 units.

DSCR Rental Loan Rates + Terms

Want to learn more about BRRRR?

eBook | Breaking Down BRRRR

Check out Kiavi’s new eBook, Breaking Down BRRRR: Your guide to building a rental portfolio quickly and profitably using the BRRRR method. In it, we walk you through the financing of BRRRR and illustrate the cash-on-cash return of BRRRR vs. turnkey.

Webinar | Building Your Rental Portfolio with BRRRR

In this 30-minute session from our Insights webinar series, you'll hear from Lukas Vanagaitis, a Pro real estate investor. After starting from scratch in 2017, Lukas now runs Horus Homes, a multi-million-dollar business with over 100 transactions under his belt. Listen in as he shares ideas, tools and strategies that have allowed him to scale profitably with the BRRRR method.

Kiavi gives me the confidence to not only access reliable capital to close more deals, but provides a fast platform and industry support that helps my company scale.