Bridge Loans

Bridge the gap with fast short-term financing

Unlock fast and easy capital, offering high leverage—up to 95% LTC / 80% ARV. Perfect for investors who need to move fast, our loans help you outbid competition and maximize returns.

Quick closing

Close in as few as 7 business days to compete with cash buyers

Tech-driven approach

Fast approvals and personalized pricing that prioritizes the property's potentialHigh leverage

No need to drain your own funds. We offer up to 95% LTC / 80% ARV

Speed up your real estate investment game

Our bridge loans outpace conventional banking speeds, setting you up to close in as fast as 7 days with an in-house servicing team and no 3rd party appraisals. Say goodbye to tedious paperwork like pay stubs and W-2s; our tech-driven platform cuts through the clutter to offer faster approvals and personalized pricing to maximize your deal.

Bridge Loan Rates + Terms

Bridge loans tailored for your real estate strategy

Get tailored financing that supports three types of transactions on non-owner occupied properties, including single-family residences, manufactured homes, 2-4 units, condos, and PUDs.

New purchase

Get the funds for both purchasing properties and up to 100% of the rehab costs. Our quick closing capabilities let you compete effectively in a market dominated by cash offers.

Refinancing for flexibility

Leverage your assets with the option to refinance within six months. Kiavi empowers you to maintain liquidity and leverage for continuous investment.

Seasoned financing options

If you've held a property for more than six months, our bridge loans can provide the extra financial support needed to achieve your investment goals successfully.

Get a fast financing estimate

Stop guessing and start investing with confidence! Kiavi helps you quickly estimate your financing options—simply add a few project details like the property address and rehab scope to unlock an estimate for:

- After Repair Value (ARV)

- Cash to Close

- Interest Rate

- Valuation Comparables

Kickstart your bridge loan financing

Online pre-qualification

Start by getting pre-qualified easily online with just a soft credit pull. Plus, when you input a property's address into our online calculator, Kiavi's technology platform instantly assesses details like square footage and location to pinpoint the most favorable pricing and terms available.

Connect with us

Once you've pinpointed the right property, connect with us. We'll help you crunch the numbers and offer our expertise to guide your bridge loan strategy.

Submit your application

Ready to move forward? Apply without any application fees or upfront costs, ensuring a commitment-free process as you take the next step.

Discover the benefits of Kiavi's in-house bridge loan servicing

Kiavi takes pride in servicing all our bridge loans from close to payoff. Unlike others who outsource, we ensure a seamless, fast, and consistent experience with our in-house team. See how we keep things smooth even after your bridge loan closes.

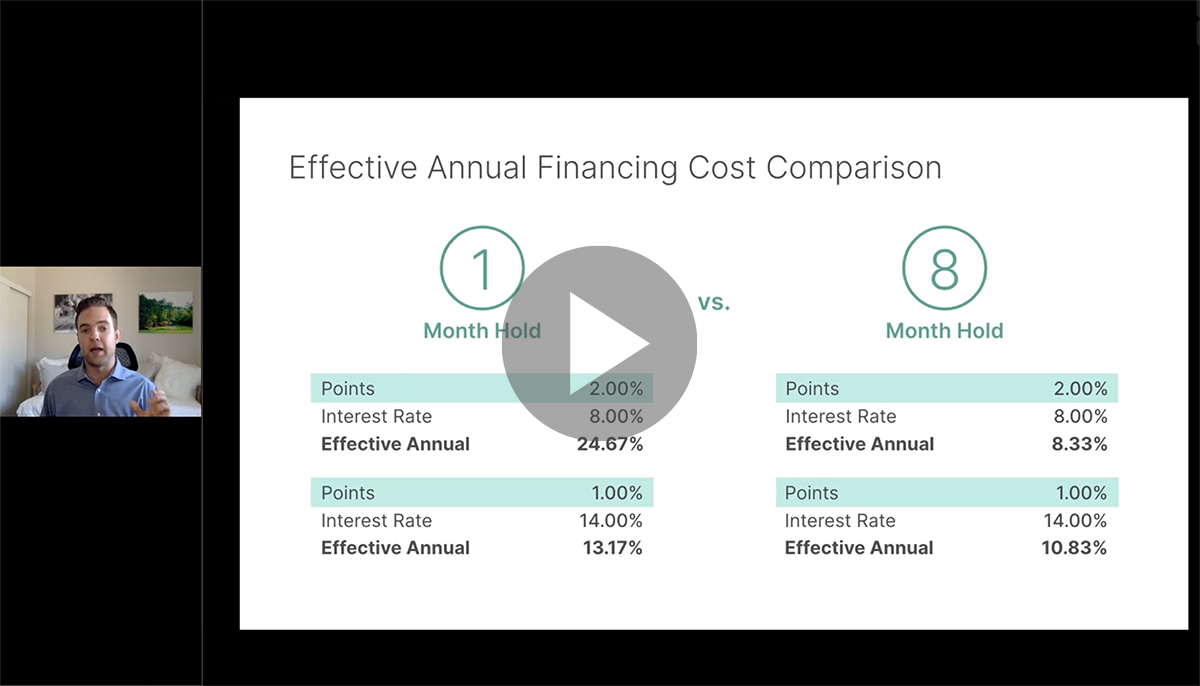

Want to learn more on how funding decisions can impact your ROI?

Real estate investors have more options in investment strategies than ever before. Kiavi walks you through the differing factors among these strategies and walks you through real-life examples of the impact of funding decisions.

Kiavi Bridge Loan FAQs

$23+ billion

of loans funded

85,000+

projects funded

45 states + DC

where we lend

Transform your house-flipping projects

Unlock our flexible loan options, fast online platform, and experienced support for your next deal. Partner with Kiavi to make your flipping journey a success story, backed by thousands of successful projects nationwide.