Maximize Cash Flow & Growth: Understanding Rental Interest-Only Loans

Editor's Note: This post was originally published in April 2021 and has been completely revamped and updated for accuracy and comprehensiveness.

Are you seeking more financing options to help you achieve your real estate investment goals? If so, you might want to consider an interest-only rental loan. This type of loan can help you qualify for higher leverage. Additionally, it can help preserve cash flow during times of rental vacancy or destabilization.

Whether you're a seasoned investor or just starting, the mechanics of a rental loan are pretty straightforward. You take out a loan with set terms and interest rates, and your monthly payments go toward both your principal loan balance and interest. Over time, you'll eventually pay off your debt.

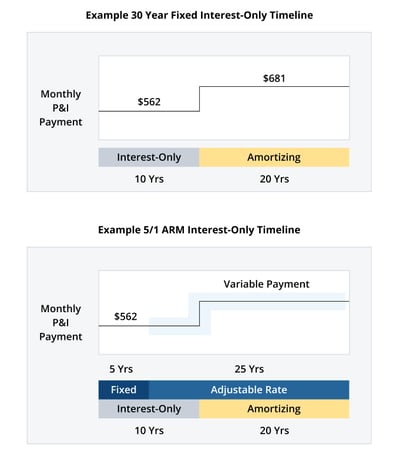

But with an interest-only rental loan, things work a little differently. Instead of paying off both the principal and interest, you only pay off the interest each month during the initial term. This results in a lower monthly payment, which can be a massive help if you want to preserve cash flow.

Once the initial interest-only period ends, you must repay the principal and interest for the remainder of the loan. This repayment requirement applies to the whole loan term.

So how exactly do interest-only loans work, and are they the right choice for your rental property strategy? Let's take a closer look.

Understanding rental interest-only loans

If you're considering financing a rental property, you've likely come across interest-only loans as an option. Unlike traditional rental loans, interest-only loans allow you to pay only the interest portion for a set period. You don't have to pay the principal balance with each monthly payment.

What does this mean? Your monthly payment may be lower than an amortizing loan. This could be beneficial if you encounter rental income changes or other financial difficulties.

The interest-only period typically lasts for a set number of years, such as five or ten. You will not make any payments on the loan principal during this time. You can still benefit from tax deductions on interest payments. You can also invest saved cash flow into other income-generating opportunities.

When the interest-only period ends, you must start repaying the loan principal. Depending on your financial situation and goals, you can do this in several ways. One option is to switch to an amortizing loan, which will require higher monthly payments, including interest and principal. Doing so will reduce your overall interest costs and help you build equity in the property over time.

One option is to refinance the loan. This could give you a better interest rate, lower monthly payments, or a longer repayment term. But remember, refinancing comes with fees and closing costs, so you'll need to weigh the benefits against the costs.

Interest-only loans can be helpful for rental property investors who want to manage their cash flow and maximize their flexibility. But it's essential to understand the risks and tradeoffs involved and plan to repay the loan principal when the interest-only period ends.

Examining the Pros and Cons: The Benefits and Drawbacks of Interest-Only Rental Loans

Benefits

As a real estate investor, you may find interest-only rental loans to be advantageous for several reasons. Here are some of the benefits that you may consider:

- Lower monthly payments: Interest-only rental loans require you to pay only the interest on the loan during the initial period. This period could last several years, resulting in lower monthly payments. This means that your monthly payments will be lower than traditional loans requiring you to pay both the interest and principal.

- Improved cash flow: Cash flow can be improved with lower monthly payments. This will give you more money to cover other costs or invest in real estate. This can help you to grow your real estate portfolio more quickly and efficiently.

- Flexibility: Interest-only rental loans can offer you more flexibility in managing your finances. You can choose to make additional payments towards the principal whenever you have the funds available, or you can continue to make interest-only payments until the end of the loan term.

- Tax benefits: In some cases, interest-only rental loans may offer tax benefits. The interest paid on the loan may be tax deductible, which can help to reduce your overall tax liability.

- Ability to leverage: Interest-only rental loans can allow you to leverage your investments more effectively. With lower monthly payments, you may be able to acquire more properties with the same amount of available funds.

Overall, interest-only rental loans can provide real estate investors with a range of benefits that can help them to achieve their investment goals more quickly and efficiently. However, it's important to weigh the pros and cons of this type of loan carefully and consult with a financial advisor before making any decisions.

Potential Drawbacks

While interest-only loans can have benefits, there are also potential drawbacks to consider, especially with rental properties. Here are some of the potential drawbacks of an interest-only rental loan:

- No equity build-up: With an interest-only loan, you only pay the interest portion of the loan each month. This means that you won't be building equity in the property during the interest-only period. This can be a problem if you plan to hold the property for a long time and want to build equity to sell it for a profit later on.

- Risk of negative cash flow: Interest-only loans can provide positive cash flow in the short term but can also lead to negative cash flow in the long term. This can happen if the rental income from the property does not cover the interest payments or if there are unexpected expenses. If this happens, you may have to sell the property or refinance the loan, which can be costly.

- Higher interest rates: Interest-only loans typically have higher interest rates than traditional loans. This means that you'll pay more interest charges over the life of the loan, which can add up to a significant amount over time.

- Repayment risk: When the interest-only period ends, you'll need to repay the loan principal. This can be a challenge if you haven't planned ahead and don't have the funds available to repay the principal. You may need to refinance the loan or sell the property to repay the principal, which can be difficult if the property value has decreased.

- Property value fluctuations: Rental property values can fluctuate depending on market conditions, and an interest-only loan can increase your risk if the property value drops. If the value of the property decreases, you may owe more on the loan than the property is worth, making it difficult to sell or refinance the property

Final thoughts

Overall, interest-only loans can be useful for real estate investors who want to optimize their cash flow and leverage. However, it's crucial to weigh the pros and cons carefully and to have a clear plan for managing your debt and building your wealth over time.

If you want to enhance your rental property strategy and maximize your cash flow, a rental interest-only loan from Kiavi may be the solution you're looking for. Kiavi offers rental interest-only loans for investors at all levels. With our user-friendly online platform, you can easily use our Rental Rate Calculator to assess your rental rate and get pre-approved for an interest-only loan.