Unlocking Investment Success: The Real Estate Agent's Guide to LTV

Ever wondered how to gauge the true potential of an investment property or what lenders consider when they're hammering out the financing details?

Getting to grips with Loan-to-Value (LTV) ratios will illuminate these areas, offering you and your real estate investing buyers a clearer path through the financial thicket. While we're at it, we'll touch on how solutions like those offered by Kiavi can align with these crucial metrics. Ready to enhance your real estate acumen? Let's unpack LTV.

Crunching the numbers: LTV explained

How do you determine the sweet spot between a safe loan and a wise investment? The Loan-to-Value ratio is your guiding star.

It's a simple formula: divide the loan amount by the property's appraised value to get a percentage. The lower the LTV, the less risky the loan is from a lender's perspective. But it's not just about safety — LTV also impacts the loan terms offered.

In a market where private and hard money lending has become more nuanced, understanding LTV isn't just helpful. It's vital for steering your investors through the complexities of financing.

Importance of LTV for real estate investors

Savvy investors give LTV ratios prime real estate in their decision-making process. Why? Because LTV is like a property’s financial pulse—it measures investment risk and borrowing power, serving as a critical indicator of loan security for lenders and investors alike.

For fix-and-flip strategists, LTV helps in identifying properties with the best upside potential versus the cost. Buy-and-hold aficionados use LTV to determine properties' long-term value and profitability, ensuring their investment grows steadily with time. Understanding LTV means investors can confidently navigate real estate's financial currents, whether they're flipping houses or building a rental empire.

LTV in action: A theoretical deal story

Imagine a seasoned investor, Alex, scouting a property with potential in a booming neighborhood. Let's dive into the dollars and cents with Alex.

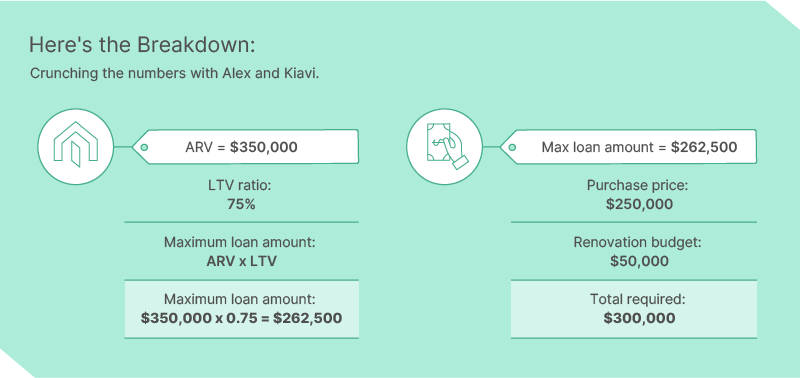

He's eyeing a promising property listed for $250,000. The neighborhood's on the upswing, and he's calculated an after-repair value (ARV) of $350,000.

Alex approaches Kiavi for financing. Together, they analyze his renovation budget—$50,000—and calculate an ARV-based LTV of 75%.

- ARV (after-repair value): $350,000

- LTV ratio: 75%

- Maximum loan amount: ARV x LTV

- Maximum loan amount: $350,000 x 0.75 = $262,500

Given the purchase price and renovation costs, here's how much Alex will need:

- Purchase price: $250,000

- Renovation budget: $50,000

- Total required: $300,000

Kiavi's loan covers most of the purchase price, but Alex must cover the remaining costs out of pocket. With Kiavi's competitive LTV terms - like up to 90% LTV - Alex proceeds with the deal, confident in his investment and partnership with Kiavi.

Kiavi's loan covers most of the purchase price, but Alex must cover the remaining costs out of pocket. With Kiavi's competitive LTV terms - like up to 90% LTV - Alex proceeds with the deal, confident in his investment and partnership with Kiavi.

Kiavi’s approach to LTV

At Kiavi, LTV isn't just a metric—it's a cornerstone of smart investment strategy. Kiavi's approach caters to savvy investors like Alex, who understand the importance of leveraging every dollar.

We offer competitive LTV ratios and high leverage of up to 90%, ensuring investors have ample room to maneuver financially. It's about balancing risk and reward, providing a safety net that aligns with the real estate investor's vision of value creation.

By integrating LTV into a broader financial package, Kiavi can help your buyers unlock an investment property's potential without overextending their cash reserves. It's a partnership that looks beyond the numbers to the future possibilities of each real estate project.

Navigating LTV with your buyers

When it comes to discussing LTV with your real estate investing buyers, clarity is vital. Break it down as the balance between the loan amount and the property's appraised value. It's the barometer for assessing risk and determining how much skin they'll have in the game.

Lay out the numbers in plain sight. Walk them through scenarios, showing how different LTV ratios affect their down payment and interest rates. Use Kiavi's approach as an example—how a strategic LTV can lead to a successful investment and how it fits into their long-term plans.

You can illuminate the path, helping buyers see where LTV fits into their investment puzzle and aligning their decisions with their financial comfort zone and investment goals.

Final thoughts

There you have it—LTV in a nutshell. For the seasoned real estate agent, mastering the nuances of LTV ratios can be a game-changer. It's about giving your buyers the knowledge to make empowered decisions that align with their investment strategies.

A solid grasp of LTV ratios can set the stage for successful investment projects. And with financial allies like Kiavi, who see beyond the numbers to the potential in every deal, your buyers are well-equipped to turn real estate opportunities into realities. Here's to a future of informed investments and thriving partnerships!