Quick Guide to Using a Delaware LLC for Real Estate Investment

In real estate investing, lenders often have specific requirements for the structure of the borrowing entity. This requirement is especially common in the portfolio lending space. One such condition is using a Delaware Limited Liability Company (LLC) as the borrowing entity.

Read on as we explore why lenders often prefer Delaware LLCs and what this means for real estate investors.

Favorable Business Climate

Delaware is known for having a favorable business climate, with fair laws and regulations that are attractive to businesses and investors. Delaware LLCs are subject to fewer regulations and restrictions than other states, making them a popular choice for real estate investors.

Confidentiality

Delaware LLCs offer more privacy and confidentiality than other business structures, which can be important for real estate investors who prefer to keep their investments confidential. So if you're looking for anonymity, a few states offer such protections in addition to Delaware. These other states are Nevada and Wyoming.

Asset Protection

Delaware LLCs can provide real estate investors with a high level of asset protection, as they offer liability protection for the owners and operators of the company. This protection is significant for real estate investors who want to minimize risk exposure. Holding all of your properties in one holding company is risky. Putting tranches of properties in separate LLCs helps diversify risk.

Tax Advantages

Delaware LLCs may offer tax advantages for real estate investors, such as choosing between being taxed as a partnership or a corporation. This flexibility could be necessary for real estate investors who want to minimize their tax liability. Talk to a professional tax advisor regarding your particular tax situation.

Reputation

Delaware LLCs have a well-established reputation for being a reliable and trustworthy business structure, which is why many lenders prefer them as the borrowing entity. This reputation can be important for real estate investors who want to ensure that their investment is secure and that they can access the best financing options.

Special Purposes Entities

In a worst-case scenario - if times are tough and there is a foreclosure scenario – lenders may not want the properties that are subject collateral to their loan to be comingled with other properties that could be collateral to another lender's loan. Then you have multiple lenders fighting in court for potentially years to try and unwind the situation.

Dividing assets into separate LLCs can be much easier for all involved parties. These are called Special Purposes Entities. A special purpose entity is a legal entity created for a specific purpose or transaction.

For example, if you're refinancing 20 properties, you would form an entity specifically for that loan and not place any additional assets into that entity after the loan closes because you formed that entity for the initial refinance. Any additional properties you add to your portfolio must be owned by another LLC.

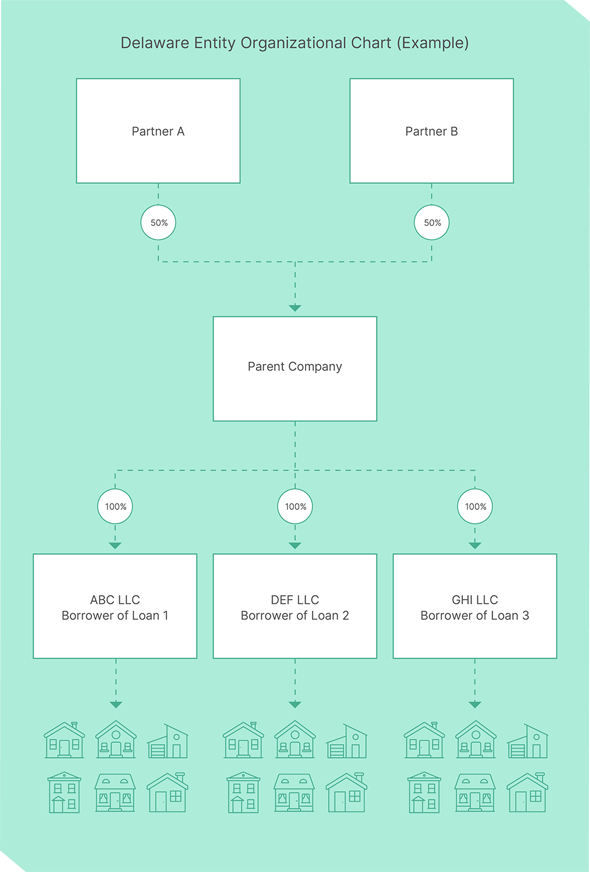

Often what investors do is have a parent company that owns all of their subordinate entities. Those subordinate entities are the entities that hold the properties. The subordinate entities are also the "Borrowers" of the loans. Please see the example org chart below and discuss with your attorney what is best for you.

Final thoughts

Delaware LLCs are attractive for real estate investors who want to take advantage of favorable business laws, privacy, asset protection, tax advantages, and a well-established reputation. Using a Delaware LLC as the borrowing entity, real estate investors can ensure that they have access to the best financing options and that their investment is secure.