Approaches You Can Take to Improve Your FICO® Score

As you look to build your real estate investment business, a solid FICO® Score is an important tool for accessing financing and maximizing your ROI. Lenders like Kiavi need an efficient way to decide whether or not to qualify you for a loan and what interest rates to offer. In most cases, lenders look at your FICO Score to determine your creditworthiness before pre-qualifying your application and approving your loan.

So, let's take a look at FICO Score, how it's determined, and some steps you can take to improve your score over time.

Why is FICO so important?

It's a three-digit number that can determine a lot throughout your life. The higher your score, the higher your approval rates are, and the greater your access to competitive rates is.

A strong score can save you thousands of dollars in the long run on interest alone. Typically, a FICO Score of 680+ will pre-qualify you for fix-and-flip and rental financing for real estate investors looking to leverage financing. A score of 720+ will oftentimes allow you access to a lender’s better rates.

With an exceptional credit score, you can enjoy:

- A better chance for loan approval

- Easier pre-qualification for financing

- Lower interest rates

- Getting approved for higher credit limits

- Bragging rights

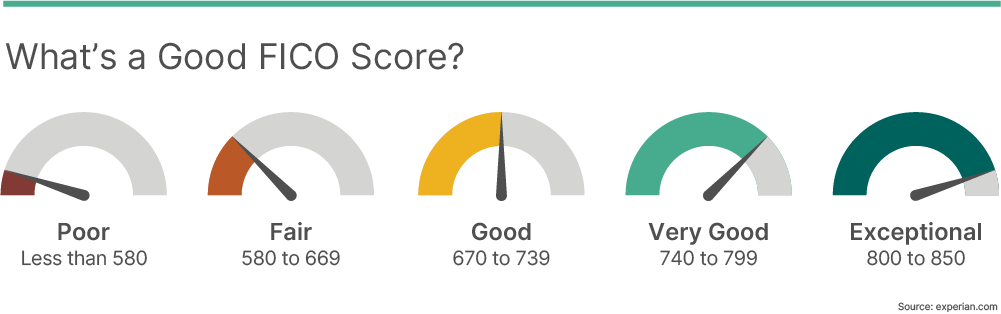

FICO Score ranges

FICO credit scores range from 300 to 850. This range is broken up into different categories to represent the likelihood of repaying debts and the amount of risk to lenders. According to Experian, there are five credit score categories, ranging from Poor to Exceptional and 67% of Americans have a Good FICO Score or better1.

- Poor (less than 580). A score in this category is well below average, and these borrowers are considered to be risky.

- Fair (580 to 669). This range is considered Fair on the FICO scale. Some lenders may approve these borrowers, though they likely won't offer them good terms.

- Good (670 to 739). FICO Scores in this category are at or above the national average. Most lenders are willing to finance these borrowers.

- Very Good (740 to 799). A Very Good FICO Score is above average and shows lenders that the borrower is low risk and likely to remain in good standing.

- Exceptional (800 to 850). These borrowers will most likely get approved and access the most competitive rates and other loan terms.

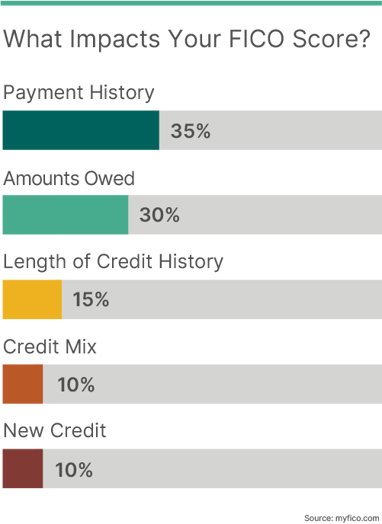

Factors that affect your FICO Score

Now that we know what a good FICO Score looks like let's look at the contributing factors that determine your score. After all, you can't start taking steps to improve it until you know what needs to be improved.

Your FICO Score is generally based on five primary factors, each with its own significance, considering both positive and negative information in your credit report2.

Payment History (35%) Payment history is what most impacts your credit score. Payment history comprises several factors like the number of late payments and public records like lawsuits and bankruptcies.

Amounts Owed (30%) The amounts owed category reflects the total outstanding balances on all your accounts—or how much money you owe.

Length of Credit History (15%) Basically, the longer your credit history, the higher your score. This can be a more challenging item to manage—especially if you're building credit for the first time.

Credit Mix (10%) Your credit mix combines different account types on your credit report, including revolving lines of credit and installment loans. For example, if you only have credit cards (revolving credit) on your credit report, applying for a small personal loan could be a good idea and then making payments on time.

New Credit (10%) This factor refers to the age of your new credit. If your credit report lists several recently opened accounts and hard credit pulls, your score could take a hit, and lenders will be more likely to view you as a risky borrower.

Steps you can take to improve your FICO Score

Now that you know what makes up your FICO credit score, here's what you can do to get it moving in the right direction. These 5 steps target each of the primary factors mentioned above.

First things first – check your credit reports

Did you know that studies show that one in four consumers identify errors on their credit reports that might affect their credit scores?3 That's why you must check your credit report–it's your source of truth in navigating where you need to get to work to make improvements. Plus, you can look for any errors and inaccuracies.

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies (Equifax, Experian and TransUnion). You can also request a copy from AnnualCreditReport.com.

Once you have your credit reports in hand, review them line by line for accuracy. If you find any errors, you can dispute them by contacting the bureau(s) directly to correct the error(s) and verify that all the information is correct. This alone could quickly improve your credit.

Improve your payment history

Because your payment history carries the most weight in calculating your score, you should first look to make improvements here. While it's pretty apparent that not making payments to your credit accounts will damage your score, many don't realize that late payments can also be damaging, and they can stay on your credit report for seven years. If you have a history of being behind on payments, you must change this behavior as soon as possible.

One best practice to ensure you make payments on time is to set up automatic charges to your credit accounts. This is easy to set up either through your bank or the creditor. Just make sure you have enough money in your account each month to cover the payments. Otherwise, you could be charged with insufficient funds and late payment fees.

While it's ideal that you pay your statement balance in full each month, and you should do this if you can, ensuring that you make the minimum payments on time each month will also keep your accounts in good standing.

Work on your debt-to-credit ratio/credit utilization

The second most crucial factor in calculating your credit is the amount of revolving credit you're using divided by the total amount of credit available to you. This is referred to as your debt-to-credit ratio or credit utilization4.

The lower your credit utilization, the better you look to lenders as it reflects that you aren't overextended and responsible. According to FICO, the average credit utilization for consumers with a FICO Score of 785+ is 7%5. This shows that the lower the total credit you use, the higher your credit score could be – it also provides a percentage goal (7%) that you can work toward to boost your score.

One quick way to lower your credit utilization is to ask creditors for a limit increase. Again, this approach aims to increase the amount of credit you have while keeping your debt low to improve your credit score. However, this route could be dangerous if you have the tendency to be a big spender. The trick here is to be responsible if the increases are approved and be careful not to overspend.

If you cancel too many accounts without taking your credit utilization into account, you could negatively affect your credit score. Additionally, canceling accounts could adversely affect the overall age of your accounts, which can also lower your score. Also, remember that closing an account will result in less overall credit, so use caution when closing accounts.

Tend to any collection accounts

Late payments can appear on your credit report as a negative entry and can stay on your credit report for up to seven years, which lowers your credit score6. If you fail to make payments and the account goes into collections, it can also be added to your credit report as a separate account7.

When a debt is transferred to collections, your account is flagged with a collection status. This status can cause a significant decrease in your credit score. However, this negative impact on your score will decrease over time, especially if you adopt positive financial habits.

It's vital to your credit score and overall financial health to sort out any issues you have with lenders and debt collectors. You can start by reviewing your credit reports if you aren't sure who to reach out to or how to pay off old collection accounts. Make sure to request a debt verification letter before you pay a lender claiming you owe them money.

A best practice is to not make payments to collection agencies without confirming that the debts belong to you. Check your records to ensure the balance is correct, and contact the original debtor to ensure that you work with the appropriate collection agency7.

Don’t forget the rest! Credit mix and new credit inquiries

Account age

As the average age of your credit account increases, so does your credit score. It indicates you're a good borrower when you've maintained credit for a more extended time. That's why it's good to keep your oldest accounts active. Keep in mind that some banks will automatically cancel old inactive accounts, so use your older accounts enough to keep them active.

Credit mix

Your credit mix is the variety of loans in your credit file and how well you manage that blend. Installment credit includes mortgages, student loans, auto loans and personal loans. Revolving credit includes credit cards and lines of credit. According to Experian, one of the three main credit bureaus, "an ideal credit mix includes a blend of revolving and installment credit."8 So, it's a good idea to be mindful of balancing your credit mix when working on improving your score.

New Credit

Be conscious of the number of new accounts you open or apply for. This doesn't mean that you shouldn't open any new accounts, but it's best not to open them too rapidly. According to FICO, "opening several new credit accounts in a short period of time represents greater risk - especially for people who don't have a long credit history."

Beware of too many hard inquiries or “hard pulls” within a short time period. A hard pull typically occurs when you apply for a new line of credit, such as a credit card or loan. It means that a creditor has requested to look at your complete credit file to determine how much risk you pose as a borrower. Hard inquiries remain on your credit report for two years and affect your FICO Score for one year.9

Lenders can also do soft inquiries or “soft pulls” that typically occur when a company checks your credit as part of a background check, usually to pre-qualify you for a loan or credit offer before you apply. Unlike hard inquiries, soft inquiries won’t affect your credit scores.

Final Thoughts

There's no quick way to improve your FICO Score. It takes patience and discipline. However, achieving a good–or exceptional–score can provide real estate investors with many benefits toward qualifying for financing and maximizing ROI. The best way to achieve financial health and maintain a better score is to manage your credit responsibly over time. Developing and maintaining sound financial habits, as discussed here, will help you preserve a consistent credit history.

Sources:

1Akin, Jim. “What Are the Different Credit Score Ranges?” Experian. Experian, November 14, 2021. https://www.experian.com/blogs/ask-experian/infographic-what-are-the-different-scoring-ranges/

2 FICO. “How Are FICO Scores Calculated?” myFICO, February 23, 2022. https://www.myfico.com/credit-education/whats-in-your-credit-score.

3 FTC. “In FTC Study, Five Percent of Consumers Had Errors on Their Credit Reports That Could 4 Result in Less Favorable Terms for Loans.” Federal Trade Commission, September 18, 2021. https://www.ftc.gov/news-events/news/press-releases/2013/02/ftc-study-five-percent-consumers-had-errors-their-credit-reports-could-result-less-favorable-terms.

4 Equifax. “Debt to Income Ratio vs Debt to Credit Ratio.” Equifax. Accessed August 15, 2022. https://www.equifax.com/personal/education/credit/score/debt-to-income-ratio-vs-debt-to-credit-ratio.

5 Kaufman, Rob. “Top 7 Fun & Interesting Credit Facts.” myFICO, May 29, 2019. https://www.myfico.com/credit-education/blog/credit-score-fun-facts.

6 White, Alexandria. “Here's How Long Late Payments Stay on Your Credit Report.” CNBC. CNBC, February 7, 2022. https://www.cnbc.com/select/how-long-late-payments-stay-on-credit-report/.

7 Kumok, Zina. “How to Pay off a Debt in Collections.” Bankrate. Accessed August 15, 2022. https://www.bankrate.com/personal-finance/debt/how-to-pay-off-a-debt-in-collections/.

8 Experian. “How the Right Mix of Credit Can Boost Your Credit Score.” Experian, July 14, 2022. https://www.experian.com/blogs/ask-experian/what-is-credit-mix-and-how-can-it-help-your-credit-score/.

9 FICO. “How New Credit Impacts Your Credit Score.” myFICO. Accessed August 15, 2022. https://www.myfico.com/credit-education/credit-scores/new-credit.