Jumbo Loans

Reliable capital at scale for large real estate projects

Jumbo loans from $3-10 million with the flexibility and VIP service you need to tackle your most ambitious deals.

Jumbo loans with speed and scale

Kiavi’s Jumbo loans are designed for real estate investors with large projects that need reliable financing. Fix-and-flip, New Construction, and Bridge loans up to $10 million with streamlined processes, competitive rates, and flexible terms. Whether you're creating luxury single-family houses or building multifamily properties, Kiavi has the scale to bring your most ambitious projects to life.

Scale to match yours

Enjoy peace of mind by partnering with one of the largest private lenders to real estate investors with consistent, reliable capital and proven scale.

Flexible, competitive financing

We don’t believe in one-size-fits-all financing when it comes to big projects. Custom pricing and competitive terms as unique as your project.

Dedicated VIP service

White-glove service from a dedicated expert as your single point of contact. VIP service with accelerated processing to streamline your big project’s financing.

Jumbo Real Estate Loan Rates + Terms

Kiavi calculates financing terms based on the property—not just the borrower—so you can move forward with confidence.

- No Application Fee

- No Appraisal

- No Income Verification

Confidence and certainty in an unpredictable real estate market

Large, complex deals aren’t always easy, especially in today’s volatile real estate market. That’s why using a trusted, reliable financing partner is more important now than ever. With Kiavi, you can have confidence that your big project will be financed with reliable capital from one of the largest private lenders to real estate investors nationwide. And with all of our Jumbo loans serviced in-house, you’ll have a seamless, fast, and consistent experience that keeps your project smooth, from loan close to payoff.

Large real estate loans for ambitious investment projects

Kiavi’s jumbo loans finance luxury single-family homes and multifamily properties with 5-20 units.

New purchase

Kiavi can provide the funds to purchase the property and close quickly, allowing you to compete against cash buyers. Up to 100% of the building costs covered.

Refinance

Use your own cash to purchase an investment property and restore your original cash position within 6 months of the purchase.

Seasoned finance

Need some extra runway for a longer-term project? Kiavi can provide the capital you need to wrap your project up if you’ve owned the property for 6+ months.

Get answers to your jumbo loan questions

Got questions? We’ve got answers! Wondering if you’ll qualify for a Kiavi loan? Curious about whether we require appraisals? Let us help you find what you need.

With more than $23+ billion in funded loans, Kiavi is one of the nation’s largest private lenders to residential real estate investors (REIs). Kiavi harnesses the power of data & technology to offer REIs a simpler, more reliable, and faster way to access the capital they need to scale their businesses. Formerly known as LendingHome, Kiavi is committed to helping its customers revitalize the approximately $25 trillion worth of aged U.S. housing stock to provide move-in ready homes and rental housing for millions of Americans across the country. For more information, visit www.kiavi.com. NMLS ID #1125207.

Unlike traditional conventional bank loans, a hard money loan is based on the value of the property being used as collateral, not just your financial position. While the rates are typically higher, hard money loans are attractive for real estate investors because they tend to close much faster, provide flexible terms and you can pay them off quickly to offset costs, allowing you to scale your business faster. Here are just a few additional benefits of hard money loans:

- Access to quick capital and fast turn times

- Flexible terms with various repayment schedules and loan durations

- Up to 90% money financed based on the property value and your renovation budget

- The more you work with the same lender, the more benefits you may receive such as reduced origination fee, rate, and more

Kiavi offers bridge and rental loans for purchases or refinances. A bridge loan is a short-term loan for real estate investors who prefer to finance the purchase and/or rehabilitation of their investment property rather than buying it fully in cash or taking a traditional bank loan. Real estate investors renovate these properties to either quickly sell back in the market or refinance into a rental loan.

A rental loan is for investment properties in which the real estate investor will buy and hold (and rent out to generate passive income), rather than fixing and flipping it quickly for a profit. These need to be turn-key, livable condition properties. Real estate investors use both bridge and rental loans for the BRRRR strategy to increase their portfolio and long-term cash flow.

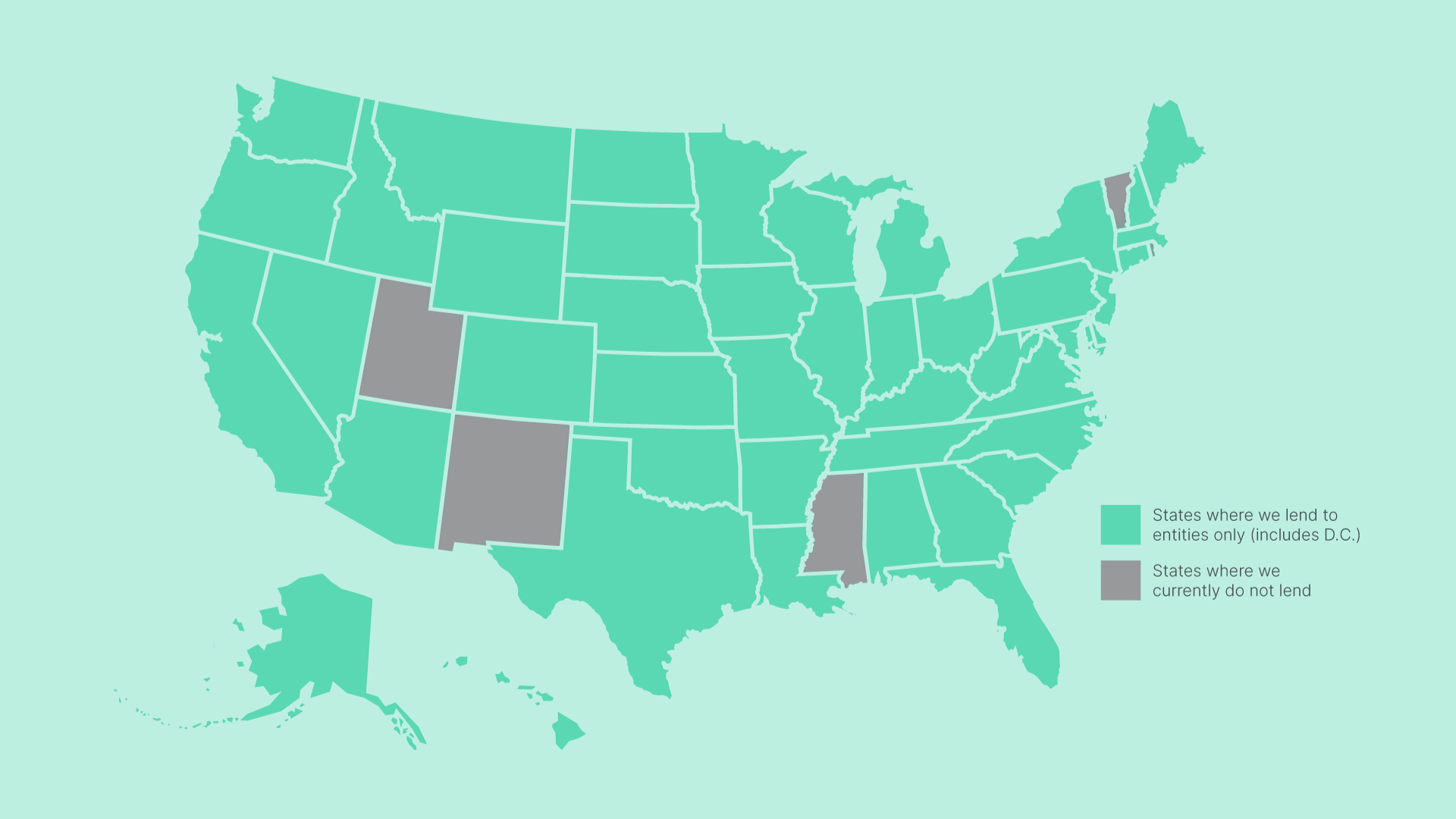

Yes. We lend to business entities in all states we offer loans. Learn more about the States we lend in.

Appraisals vary on your financing needs. We do not require appraisals on bridge loans, but we do require them for rental loans.

We pride ourselves on transparency throughout the loan process and all fees are collected at closing. We do not require an application fee and the origination fee is based on the final loan amount.

See why 17,000+ real estate investors trust Kiavi

Whether you're expanding your portfolio or taking on your biggest project yet, Kiavi is the trusted partner for jumbo loans. With reliable capital, expert guidance, and a proven track record, we make real estate investing straightforward—just like we’ve done for countless investors like you.

"My experience has been fantastic. They understood our requirements to close. They stepped up and ensured we were ready to fund a couple of days before we closed. They made it a very stress-free experience. Highly recommended!"

Orlando C.

11/01/24 via Google"I got quotes from five lenders and Kiavi's LTC and LTV were by far the best allowing me to close with the least amount of money down. The team was friendly and helpful; also patient! The seller took a long time finally getting to the closing table. It was a fast and efficient process from Kiavi's side."

KKB

11/26/24 via Trustpilot"Kiavi have been an awesome partner in helping me achieve my Real Estate investment dreams. I have worked with other companies but they completely standout in professionalism, timeliness and flexible rates options."

Oracle F.

12/01/24 via Trustpilot"I had the opportunity to work with Kiavi on several deals and I must say that my experience has been nothing short of exceptional. As someone who has had previous encounters with loan companies, I can confidently say that Kiavi stands out from the rest. "

Kimone C.

02/26/24 via GoogleLearn why we’re the trusted choice for your jumbo loan needs

We're more than just a financing partner for your jumbo loan projects. We provide the latest resources and tools to make your journey seamless. Explore our webinars, eBooks, and more to support your success.

Easy and streamlined jumbo loans for real estate investors

Unlock our flexible loan options, fast online platform, and experienced support for your next deal. Partner with Kiavi to make your flipping journey a success story, backed by thousands of successful projects nationwide.

.png)